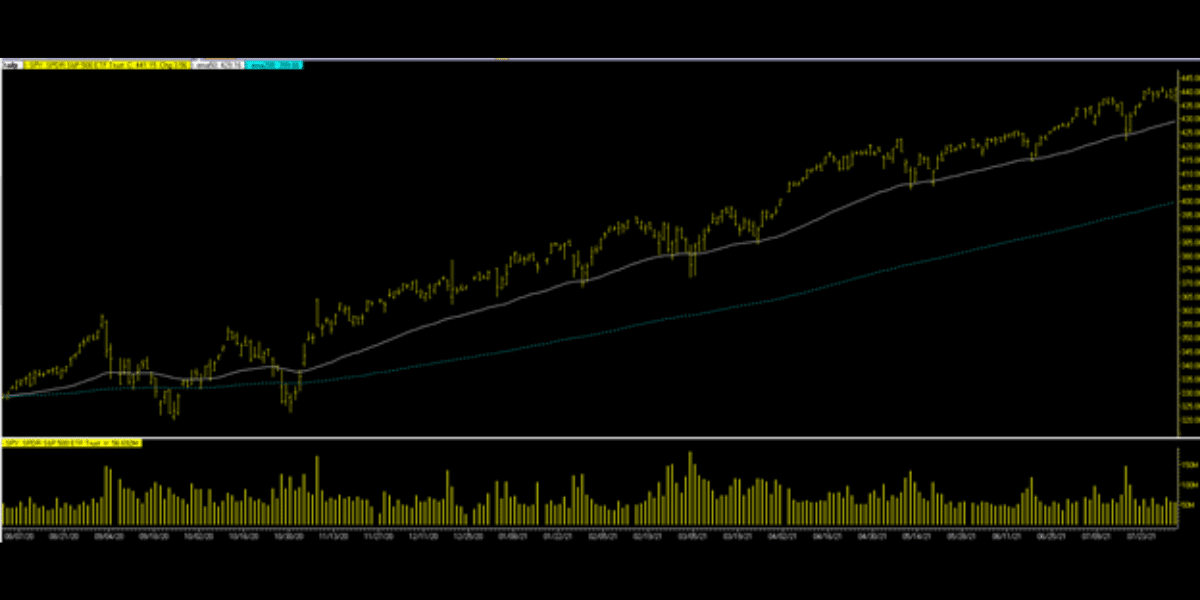

Long Term resistance: SP500 4430 – 4450

Long Term support: SP500 4250 – 4300

Markets have been in a small trading zone. The SP500 found support at 4250 and resistance just over 4400. As we move into August, the markets look tired and have headwinds, but I don’t believe we are vulnerable to a large decline. I do believe a 3 to 5 % pullback can happen over the next three months. If you don’t have some cash, it may not be time to reduce risk assets. DO NOT sell all your positions. That is market timing. We prefer buying on pullbacks and selling on rallies. The Markets will have to deal with some summer Hedge fund selling and over evaluations. Remember, the FED is still inserting $110 billion per month into the bond market and provides funds to support the Markets.

In summary, if the SP500 breaks over 4450, expect a move close to 4500, but if we break SP500 4475, I would expect to retest 4250. Remember, the time from August through October is when the Markets have been vulnerable to declines. Make sure you can buy on a pullback; just don’t expect a big one.

Stocks ended the day lower with the DOW, S&P, and...

Stocks ended the week higher, with the DOW, S&P and...

U.S. stocks closed up today as the market bounced back...

March is traditionally an “average” month for the market. Over...

January was the 3rd consecutive positive month for the S&P...

January is traditionally a good month for the market as...